Call us at 1(866) 607-4438

Average Credit Card Debt Statistics

(Updated January 2021)

As of quarter 3 in 2020, the average credit card debt has decreased for the first time in several years. Time will tell the economic effects of the COVID-19 pandemic and whether credit card debt will continue to decrease or not. The average American debt per household is also continuing to climb due to the ever increasing out-of-pocket healthcare costs among other things.

Whatever the case may be, the average debt credit card users have is increasing. On average, an American has 2.7 credit cards.On this page, we will look at the average household debt by country. We will also zoom in to look at the debt average by state, gender, age, generation, income level, & race.

Average U.S. Consumer Debt Statistics Profile:

2020 Credit Card Debt Statistics

2019 Credit Card Debt Statistics

Average Credit Card Debt Statistics by Country

This is a breakdown of the average credit card debt 2020 statistics of the top 10 countries by Gross Domestic Product (GDP). Theoretically, one might expect the countries that have the lowest amount of credit card debt to be the top GDP country. However, that is not the case, as this list is ranked from 1-10 by GDP, but the average credit card debt by country does not line up with the GDP rankings.

Average Credit Card Debt Statistics by State

Some state rankings may be surprising, as the general trend is that the higher populated states have higher credit card debt. However, the state with the highest credit card debt, Alaska, has the 3rd lowest state population.

States with the lowest average debt are Iowa, Wisconsin, Kentucky, South Dakota and Idaho. States with the highest debts include Alaska, New Jersey, Connecticut, Virginia & Maryland, a good sign as the average debt in America continues to rise. The District of Columbia is not shown in this graph of the average credit card debt by state.

Average Credit Card Debt Statistics by Gender

By a fairly wide margin, females carry less credit card debt than males. Trends show this most likely due to women using their cards for smaller purchases, where as men tend to use their cards for big purchases.

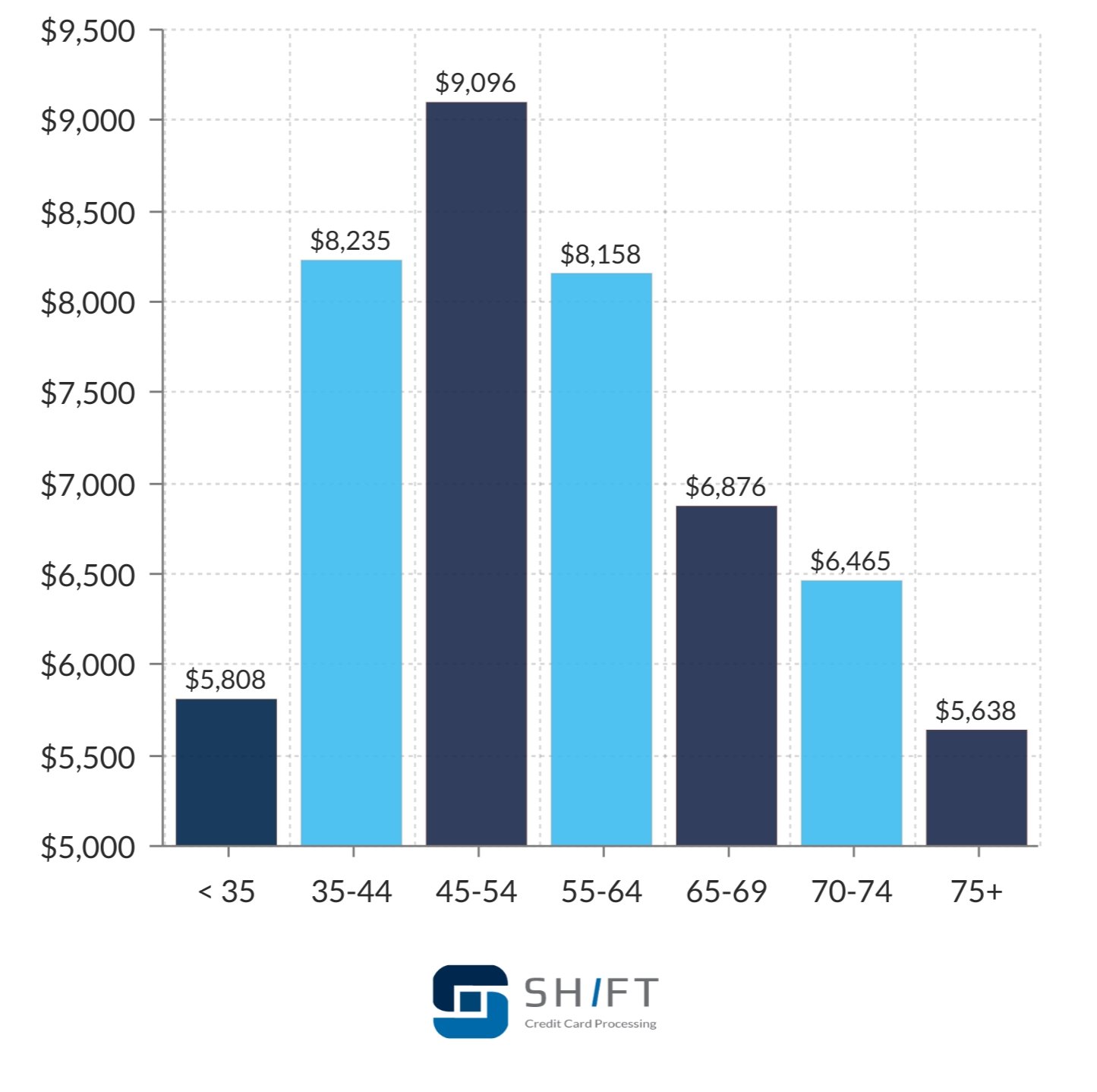

Average Credit Card Debt by Age

A breakdown of average credit card debt by age is probably the most predictable categorical breakdown on this list.

The stats on people under 35 include millennials that do not have credit cards, therefore bringing down the average household credit card debt. However, the lowest average debt by age is held by the 75 years + group. However, the 45-54 year olds have the highest average debt by age.

Average Credit Card Debt Statistics by Generation

Generation, similar to age, makes sense according to the stage of life that they are in. Baby Boomers and Generation X, being in the middle of life, tend to use the most cards and charge the most on them.

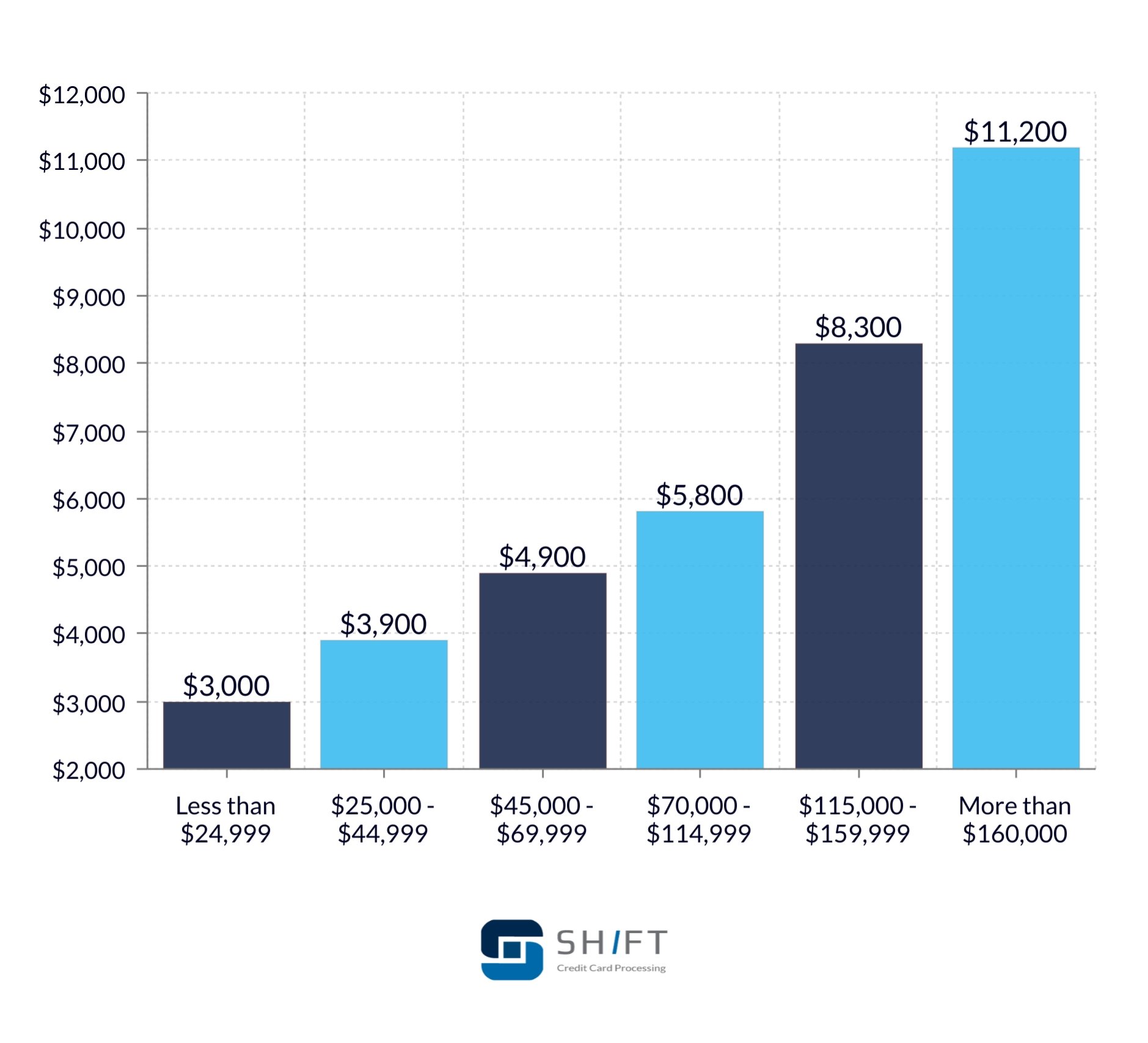

Average Credit Card Debt Statistics by Income

The breakdown of credit card debt by income level increases at a very steady and consistent rate. It makes sense, too, that with more money the average household carries and makes, the more they will spend.

Average Credit Card Debt Statistics by Race

Credit card debt statistics

downloads and resources

Data Resources

Resource Downloads

Download web optimized versions of our data charts and infographics.

2020 Update:

According to the current data available, the average credit card debt in America decreased for the first time in 8 years. Credit card usage has decreased and despite a pandemic, delinquency rates have also decreased. It is unclear whether these are the result of decreased spending in general, or the Coronavirus relief stimulus. There are likely many factors that play into this trend.

Time will tell whether the downward trend will continue as the consequences of a global pandemic remain to be seen. We will update our page as more clear data emerges about the US credit card debt amount.

Why Credit Card Debt Continues to Rise in the U.S.

Global credit card debt continues to rise, and it is no different for the credit card debt in America. The data from the Survey of Consumer Finances by the Federal Reserve Bank shows 183 million Americans now have credit cards. That number continues to climb each year.

The amount of consumer and personal debt by country resulting from increased credit usage will continue to increase as well. So, what is the average credit card debt in the US? The average credit card balance (or debt) in the U.S. is at $6,741 a person.

As more credit cards are introduced to the public, more purchases are made. This doesn’t just include every day purchases, vacations or overspending in general. Since 2009, healthcare costs have increased 33% leaving many Americans with high deductibles and having to pay more out-of-pocket for medical costs. Some are opting to put these costs on credit.

So regardless of where the money is spent, a good majority of that spending becomes debt as consumers realize that they’ve spent more than they could afford to pay in cash- by want or necessity.

According to the Survey of Consumer Finances by the Federal Reserve Bank, less families are paying down credit card debt than in the past, even with more families having credit cards. However, even with less families paying down credit card debt, credit card delinquency rates have only increased slightly.

Credit card fraud also contributes to rising credit card debt. Criminals can max out an identity theft victim's card and many times cause that victim to go into credit card debt.

So if you have a credit card, make sure you protect yourself from these hackers with some sort of anti credit card theft technology. Monitor your credit statements closely and immediately notify the issuing bank if you notice fraudulent charges.

Finally, the average debt with also continue to increase along the use of rewards cards. Cash back & other rewards cards are great in theory. Customers are likely to spend more to get more rewards back.

While it’s great marketing for the issuing banks, it comes at a very high cost to the businesses that accept the cards and to the consumer. Rewards cards carry very high percentage rates, and so interest begins accumulate if the balance isn’t paid in full every month.

Your total outstanding revolving credit card debt will continue to grow as long as the credit card account is open. Revolving credit isn’t a bad thing by itself, but when it becomes revolving debt, it can become a concern. The average revolving debt continues to rise as people put more purchases on credit cards with accumulating interest.

Ways to Avoid Credit Card Debt

The answer to "How to avoid credit card debt" is generally very simple. Don’t spend more than you have and don’t fall for all offers for rewards & cash back cards out there.

Budget carefully and don’t live beyond your means. While this can be challenging with so many different factors that impact our finances, the important thing to do is start. There are several groups on social media, budget apps, & financial books out there to help you get a handle on your finances. Remember, if you couldn't pay cash for something right now - then don't. Don't borrow from your future - save up until you have the funds in your bank account.

If you have to put something on credit, make a plan to pay it off as fast as possible. Paying interest is another way you are borrowing from your future self. So be smart and avoid building credit card debt by keeping up with your credit card payments.

Pay them immediately and don’t let them pile up on you. People tend to get in trouble when they wait to pay off their credit cards, only to see balance pile up higher & higher if not paid quickly.

Getting behind on paying your credit card balances can lead to credit card delinquency and higher delinquency rates, which will negatively affect your credit score.

One of the biggest & most dangerous ways people accumulate credit card debt is through using it to obtain a cash advance. Using credit card accounts to get cash is very costly and cannot mean good things for your financial situation. This is largely because it comes at a very high cost to you - the percentage rates on these are usually astronomical- and using credit for the purpose of getting cash is usually a last resort.

There’s no reason to use a credit card for cash if you have the money in a standard checking account.

Conclusion

Paying off credit card debt is obviously very important in many different aspects, including building a positive credit history and keeping your interest rate as low as possible. A low interest rate will result in you saving money through smaller credit card payments.

Just as managing student loans or business loans can lead to an improved credit score, so can deciding to pay off debt accumulated from credit cards. Ensure your month to month payments for all expenses are on time, including mortgage, utilities, auto loans, student loans & credit balances.

Most credit cards consumers have some sort of debt. An average American credit report would show a score of 704 which qualifies as “good.”. American households are, though, building more and more credit card debt, with the average credit card balance being $5,331.

Carrying credit card debt can cause personal problems in addition to financial problems. Finance issues are a big personal stress and add stress to a family or marriage as household debt adds up.

With that in mind, if you have outstanding debts resulting from credit cards, we recommend getting aid from someone who specializes in debt management & credit counseling to help you pay off that debt or reach a debt settlement.

Sure, there are ways to move the credit card debt, like performing a balance transfer. While that might help move the debt, it won't pay it off or clear it. Using a balance transfer card could even further complicate problems by adding to your debt with a transfer fee for each transfer.

Credit card debt is something to stay as far away from as possible. If not paid off in a timely fashion, it can result in higher auto loan, personal loan and mortgage rates. Even health insurance, life insurance and some car insurers have higher rates for those with outstanding credit card debt. It will not, however, affect social security for those that are receiving it.

If you do get into credit card debt, be sure to pay it off as quickly as possible, so that it does not negatively affect you long term.