Call us at 1(866) 607-4438

Credit Card Fraud Statistics

(Updated September 2021)

Quick Credit Card Theft statistics

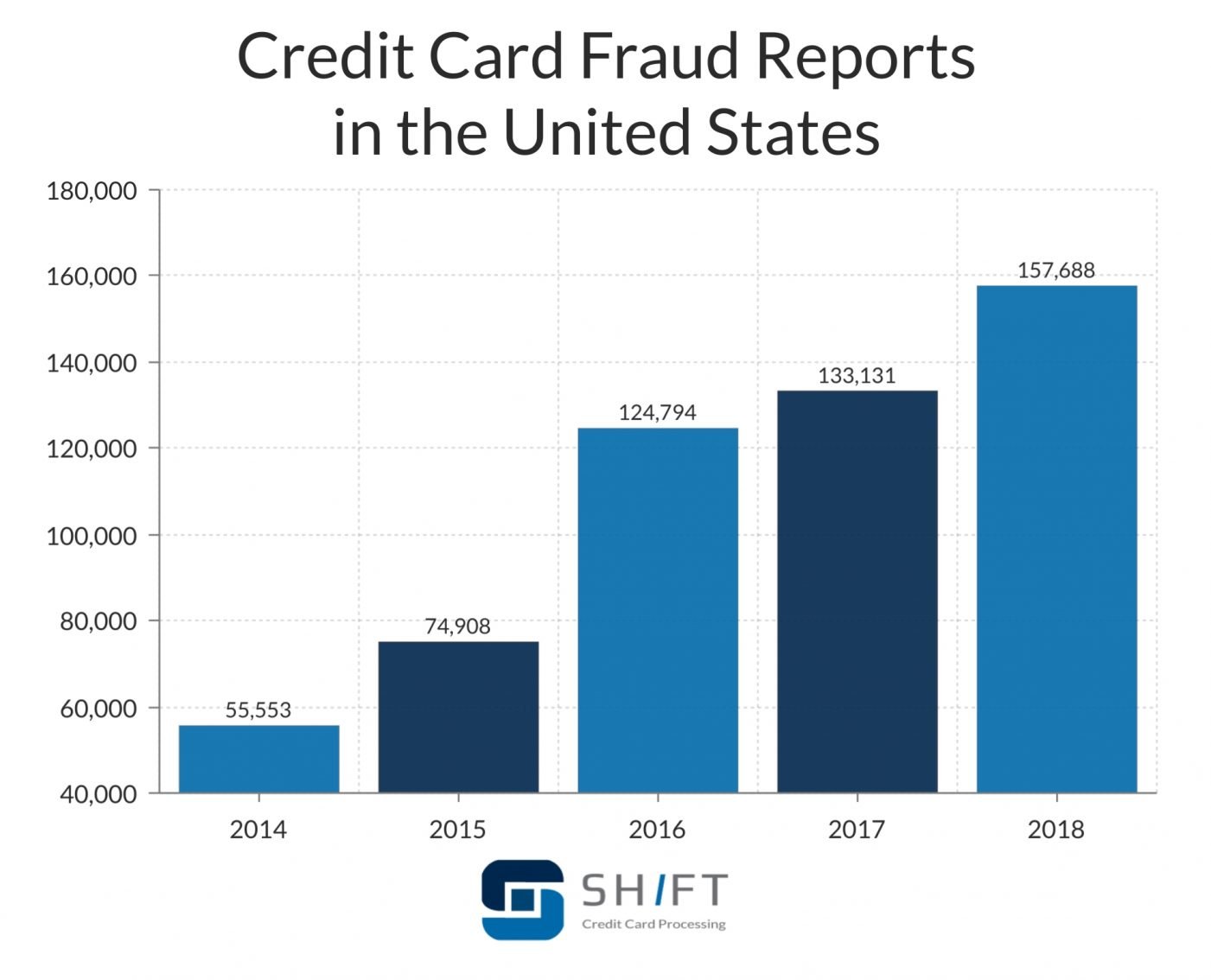

It's probably not news to you that fraud is a huge global and national problem. With the growth of the e-commerce industry and community, we will see credit card fraud rise at rates faster than ever.

Here are some important facts about credit card fraud:

What Is Credit Card Fraud & How Can It Happen?

Credit card fraud is a result of identity fraud and a type of identity theft. It happens when someone uses your credit card or credit account to make a transaction. What's the reason for this, and how can it happen?

Types of Credit Card Fraud

Ways that someone can get your information to commit credit card fraud

Online shopping now creates the greatest fraud opportunity - the security of the EMV credit and debit cards (chip & PIN) are driving more fraudulent activity to the online or e-commerce industry.

Card not present fraud is now 81% more likely than point-of-sale fraud according to Javelin Strategy.

Who Pays For Credit Card Fraud?

Because of federal law & issuer card network terms and policies, consumers are shielded from the cost of unauthorized purchases made with their cards.

Financial institutions and merchants assume responsibility for most of the money spent as products of fraud. Issuer losses occur mainly at the point of sale from counterfeit cards, while CNP transactions accounted for most of the total merchant cost.

In 2015, issuers bore 72 percent share of losses. Merchants & ATM acquirers assumed 28 percent of liability (Nilson Report, October 2016).

$24.26 Billion was lost in 2018 due to payment card fraud worldwide.

What is Identity Theft?

Identity theft occurs when someone uses information about you: name, birthday, social security number, bank statements, etc. to access your records or open new ones under your name. Credit and debit card fraud is a type of identity theft.

Identity Theft Statistics:

Credit card fraud is the most common and popular kind of identity theft and makes up 35.4% of all identity theft reports.

What age group reports the most cases of identity theft?

This study was performed by Identity Theft Resource Center. The published survey results show that over 80 percent of victims affected by identity theft experience sleeping problems as a consequence.

How Does My Identity Get Stolen?

Scammers & thieves can target and acquire your personal information via scams, theft, & information breaches. The criminal can then use your personal information (Birthday, pin number, address) to take over your existing banking accounts or open new accounts and charge it to you and your credit.

Data Breaches

Top 7 Data Breaches of All Time

Yahoo's data breach in 2013 exposed 3 billion consumers in total and is still the biggest single data breach

First American Financial Corp. had 900 Million customer files exposed in May 2019

Facebook - 2019- 540 million users’ information exposed from the social media company

The biggest breach in 2018 was by Marriott International which exposed as much as 500 Million records

Adult Friend Finder in 2016 had 412 Million records compromised

Equifax in 2017 had 143 Million records exposed

Capital One in 2019 had more than 100 Million records which could have been exposed

Other Avenues for Scammers to Get Your Information

Consumers need to be vigilant & wise when giving their personal account information. Scams come from a variety of different services. According to the consumer sentinel network 2018, most of the consumers who were affected by fraud were contacted by scammers via phone or email and that losses of $429 million were incurred due to this kind of phone fraud.

What can you do to protect yourself?

If you have a credit card, understand that this kind of fraud will always be a risk as long as you have a card. However, there are some easy steps you can take to reduce your risk. There are also some financial services, tools, and programs, available to help limit your risk and aid your search for protection.

Be a smart shopper

Keep your purse or wallet secure and close to you at all times. Never carry your social security card. When shopping or making other online payments, make sure you are using reputable businesses and organizations.

Monitor your credit card accounts

It is wise to monitor your bank statements and statements from your credit card accounts frequently. Often, fraudsters will make small transactions on your account to see if their plan will work - usually something you might not even think twice about. If that works, they usually will go ahead and make bigger purchases. Be on the lookout for suspicious transactions and unauthorized charges, and report it immediately to your credit card issuers.

Increased Fraud with Online Shopping and E-commerce

With increased online shopping, card-not-present fraud is skyrocketing. EMV terminals with chip and pin technology have decreased point-of-sale fraud significantly. But in an online shopping situation, there are no person-to-person transactions.

Card not present fraud is now 81 percent more likely than point-of-sale fraud, and is the biggest source of chargebacks across all industries. Because card-not-present fraud is the biggest source of chargebacks, eCommerce merchants are on track to lose $20 billion in 2021 because of criminal activity.

Other Tips and Tricks

With the emergence of mobile payments, another avenue of fraud has been created. Make sure that no one has the password to access your mobile payments as a precaution.

How to Report Identity Theft

If you’ve noticed unauthorized transactions or someone has used your stolen credit card, you could be the victim of identity theft fraud. The first thing you should do is notify the credit card issuers and your bank. They will usually freeze or close your account and work on changing your account number. Change online passwords and PINS for future fraud prevention.

If you suspect that you are a victim of fraud, you can also request your credit reports, as it is common that new bank records will show up there first. If you check and find one, contact the credit bureau directly to report it.

If you are one of many fraud victims, consider filing a police report to get your money back and catch the criminal. And since fraud and identity theft is a federal legal issue, you can report the crime to the Federal Trade Commission. The Federal Trade Commission tracks identity theft cases.

We know fraud can be a sensitive subject, especially to people who have been victims. We hope that the information that you've read throughout this article will help you stay and live safe from becoming a victim of fraud and all other kinds of theft in the future.

Credit card Fraud statistics

downloads and resources

Data Sources

Resource Downloads

Download web optimized versions of our data charts and infographics.